Welcome to Rise Financial Planning & Tax Recovery

Recover Federal Taxes You’ve Already Paid – Legally and Securely

Stop leaving money with the IRS. Our 100% legal paper-filing strategy helps you reclaim federal tax overpayments quickly and confidently. No upfront fees - just 20% of what we recover For You. Schedule a Free Consultation to see if you qualify!

Fortune-500 Experience for Individuals & Small Businesses

Why Choose Rise FP&A™

For over 25 years, Rise FP&A™ has been helping individuals and businesses master financial planning and strategic budgeting. Now, we’re bringing you a specialized tax overpayment recovery service designed to help you:

Legally Reclaim Withheld Federal Income Tax

Recover Past Overpayments (Up to 3 Years)

Avoid Complex Tax Loopholes and Jargon

Get Professional Support At Every Step

OUR PROCESS

TAX RECOVERY IN 5 EASY STEPS

Free (15 min) Consultation

We review your eligibility and explain the process.

Gather Your Documents

We guide you in collecting W-2s, 1099s, and other income records.

Paper Filing Submission

We prepare IRS Forms 1040 and 4852 with a cover letter for certified mail submission.4.

IRS Follow-Up

We handle correspondence and ensure your case is processed.

You Get Paid!

When funds are recovered, we retain 20% as our fee.

DO-IT-YOURSELF SUPPORT

Want to download our Free Tax Overpayment Recovery Guide & start the process yourself?

If you get stuck or need a review, we offer professional assistance to help you complete your filing with confidence.

HOW WE SERVE YOU

WHAT'S INCLUDED

Secure Document Handling (IRS-Compliant)

Expert Preparation of Forms & Letters

Ongoing Case Tracking & Updates

3-month Complimentary Access to Budget Habits™ Community for Financial Coaching

WHO WE SERVE

Keep More of What You Earn, Get Back What You're Owed

At RISE, we help overlooked taxpayers recover $10K to $1M+ in overpaid taxes each year — legally, ethically, and without stress. Whether you're a W-2 employee, small business owner, retiree, or 1099 contractor, our performance-based model means you don’t pay unless we recover your refund.

Individuals (W-2 or 1099) Income

If you’ve been paying taxes as an employee or contractor, odds are you’ve overpaid without knowing it. We’ll review your filings and recover funds most CPAs overlook — even from previous years.

High-Earning Retirees

Receiving retirement distributions (1099-R)? We help retirees recover excessive withholdings and maximize post-retirement income, no accounting headaches required.

Small Business Owners

If your business income flows through a Schedule K-1, you’re likely eligible for strategic refund recovery. We identify systemic overpayments and reclaim lost capital, fast.

Late Filers & Tax Extension Users

If you’re behind or stressed about extensions, we simplify the process and may still help you recover thousands. Credits and deductions don’t matter, our system bypasses traditional roadblocks.

START HERE - IT'S FREE

SEE IF YOU QUALIFY

TRUST & COMPLIANCE

Rise FP&A™ is a trademarked Business Trust with 25+ years of financial expertise

IRS-compliant data protection (Publication 4557 standards)

We are not tax attorneys or CPAs. This is a strategic consulting service for eligible taxpayers.

All filings are paper-based and submitted via certified mail for security and tracking.

Our Testimonials & Case Studies

Real Clients, Real Results

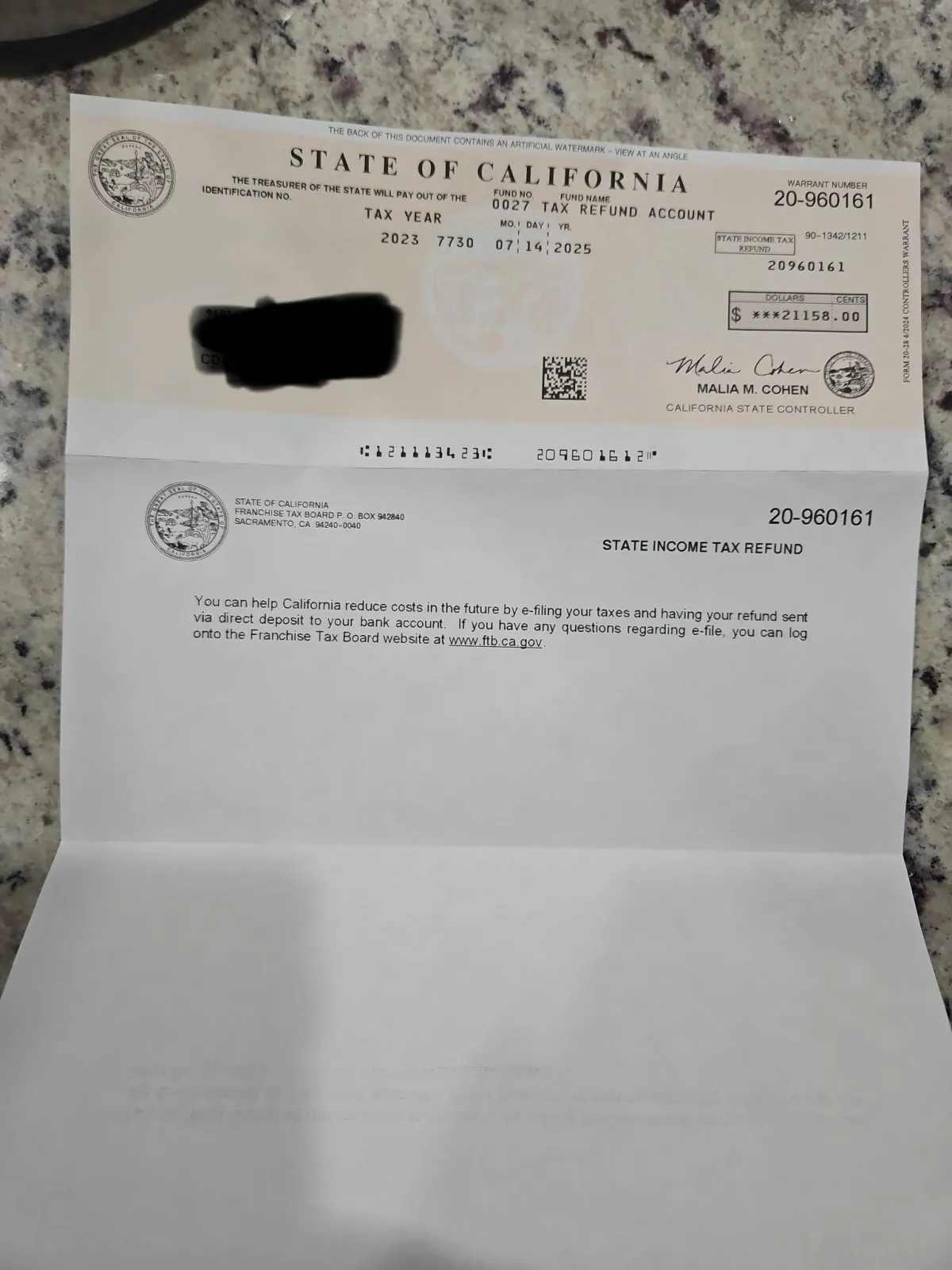

Anthony’s Multi-Year Federal & State Recovery

Before: Anthony, a small business owner filing with a Schedule K-1, had avoided filing due to large tax burdens in past years.

Action: Filed amendments for 2022 and 2023, targeting both state and federal overpayments.

Result:

California State Refund (2023): $21,158 (check)

California State Refund (2022): $835.11 (direct deposit)

Federal Refund (2023): Over $70,000 by check for 2024.

Anthony M.

Client

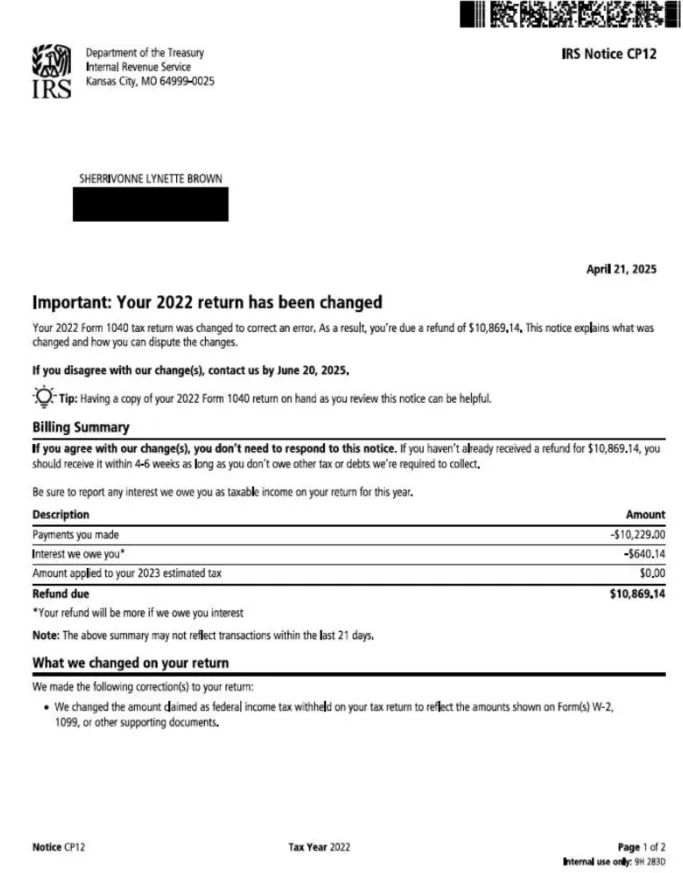

Sherrivonne’s 2022 Federal Refund

Before: Filed 2022 taxes in mid-2024. The IRS responded with multiple delays — including a 12C Notice, a verification letter, and even an unrelated “lock-in” warning.

Action: Persisted with certified mail responses, online verifications, and direct follow-ups.

Result: Received a $10,869 IRS refund check (including $640.14 in interest). The FICA portion is still in process.

Sherrivonne Brown

Founder & CEO

Call Expectations

On this call, we will:

Confirm if you qualify based on income and withholding history

Estimate your potential recovery range

Explain the exact IRS-compliant recovery process step by step

Map the fastest next steps if you qualify

What we will accomplish:

Clarity on eligibility

Clarity on timeline and documents

Clarity on how fees work, only after recovery

A decision with confidence, no pressure

Next steps after the call (if you qualify):

We request the minimum documents required

We begin the recovery process and keep you updated

You pay only after the recovery is issued

Contact Us

Disclaimer: Rise FP&A™ provides financial consulting and educational services only. We are not a CPA, law firm, or enrolled agent, and we do not provide legal or investment advice. All tax filings are self-submitted by clients; results may vary based on IRS or state review.